October 30, 2025

Mastercard integrates its MTN blockchain network with JP Morgan’s Kinexys Digital Payments (JPM Coin)

Image by Ledger Insights Today Mastercard announced it has integrated its Multi-Token Network (MTN) for tokenized deposits and tokenized assets with Kinexys Digital Payments (formerly JPM Coin). It allows clients of the two solutions to send payments across the networks. Both companies emphasized the benefits for cross border payments because of traditional challenges with speed, […]

October 30, 2025

Japan’s big 3 banks to use stablecoins, Swift for cross border payments

Image by Ledger Insights Japan’s big 3 banks, MUFG, SMBC and Mizuho are involved with with a cross border payment system, Project Pax, that aims to use stablecoins instead of correspondent banks. However, in order to ensure that corporate customers can trigger trade payments in the conventional manner via their banks, Swift payment messages […]

October 30, 2025

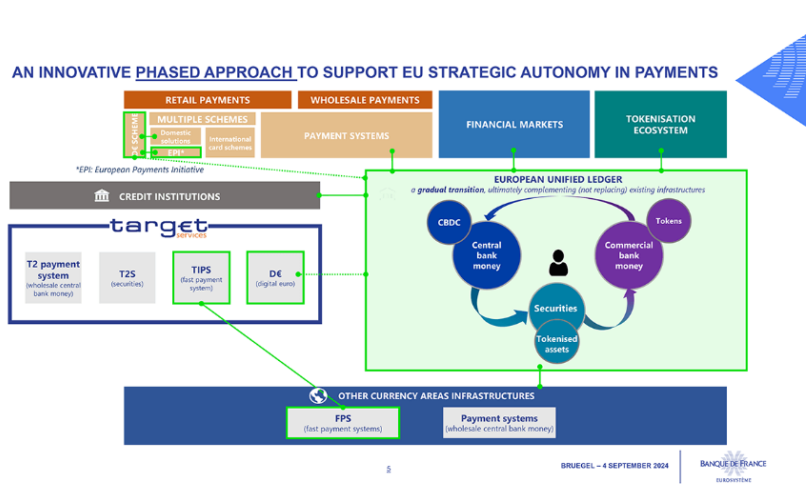

EU Unified Ledger for tokenization proposed by Banque de France governor

Image by Ledger Insights It’s well known that the Banque de France is a fan of wholesale CBDC and tokenization. It started running wholesale CBDC trials in 2020. In a speech yesterday, Governor François Villeroy de Galhau outlined his vision for a Capital Markets Union (CMU) and a Banking Union within Europe. An EU […]

October 17, 2025

HSBC, StanChart, Bank of China HK share plans for HK tokenized deposit sandbox

Image by Ledger Insights Last week we reported that the Hong Kong Monetary Authority (HKMA) launched its Project Ensemble Sandbox. The primary purpose is to trial a wholesale central bank digital currency (wCBDC) as a settlement tool for tokenized deposits. Additionally, various tokenization trials will use tokenized deposits for settlement. Some of the four […]

October 17, 2025

ICCs Digital Standards Initiative shares digital trade, eBL case studies

Image by Ledger Insights The International Chamber of Commerce’s (ICC) Digital Standards Initiative (DSI) for trade documents has come a long way since its founding in 2020. In April it published a document that outlined no less than 36 different trade documents and associated standards. Now it has released a series of 22 case studies, […]

October 17, 2025

Citi survey finds fewer institutions want CBDC for digital asset settlement

Image by Ledger Insights Today Citi published its latest Securities Services Evolution whitepaper. DLT and digital assets is one of three topics covered. A survey of almost 500 institutions found that there is less demand for using CBDC for digital asset settlement than in the past. Instead, there’s a greater emphasis on alternative digital […]

October 7, 2025

Fnality tech partner Adhara collaborates with Ownera for tokenization interoperability

Image by Ledger Insights Adhara has partnered with Ownera for tokenization interoperability. The goal is that together, the two tech firms provide financial institutions with access to digital cash and collateral across different blockchain platforms. Adhara is best known as the technology partner for the Fnality tokenized payment solution, which is backed by […]

October 7, 2025

JP Morgan, 8 Italian banks involved in Banque de France wholesale CBDC trials

Image by Ledger Insights JP Morgan, 8 Italian banks involved in Banque de France wholesale CBDC trials Image by Ledger Insights Image by Ledger Insights The Eurosystem is currently running trials for wholesale DLT settlement in central bank money. One of the three central bank payment solutions is a wholesale CBDC using the Banque de […]

October 7, 2025

Digital RMB transaction volumes hit $56 billion for one month

Image by Ledger Insights After keeping quiet about the progress of its central bank digital currency (CBDC) pilot for a year, the People’s Bank of China has now reported digital RMB volumes for two consecutive months. The cumulative figure to the end of June was RMB 7 trillion ($988 billion), up from RMB 6.6 […]

September 23, 2025

IIM Lucknow Launches Blockchain Centre of Excellence in UP

Image by The Crypto Times The center will act as a catalyst for technological innovation, providing startups with crucial resources and support. The Indian Institute of Management Lucknow’s Enterprise Incubation Centre (IIML-EIC) has announced the establishment of a Centre of Excellence in Blockchain Technology (CoE-BT), with support from the Government of Uttar Pradesh under its […]